The renegotiation of the North American Free Trade Agreement (“NAFTA”) has become an increasingly difficult process. This is unsurprising, however, because there is no agreement amongst the member countries as to why the NAFTA needs be renegotiated. Mexico and Canada regard the renegotiation process as an opportunity to modernize NAFTA. Although the United States does share this objective, the main U.S. interests in the renegotiation of the NAFTA appear to lie elsewhere. In particular, a key target for the U.S. Government in renegotiating NAFTA is reducing the bilateral trade deficits that the United States has with both Canada and Mexico. Because looking at the key facts involved is always helpful for finding a mutually agreeable solution to any controversy, in this first Post I present some basic data regarding U.S.- Mexico trade since the inception of the NAFTA.

In future posts I will comment briefly on the viability of Mexico’s alleged “Plan B” (i.e., ramping up exports to third countries) in case NAFTA falls apart, on how the United States might fare in such circumstances, and on how U.S. exports could be further boosted within the framework of the NAFTA.

The Key Facts

- According to data from the U.S. Bureau of the Census,[1] the U.S. trade deficit with Mexico reached US$ 64 billion in 2016. In that year the U.S. trade deficit with Canada was much smaller; that is, nearly US$ 11 billion. Importantly, the U.S. trade deficit with Canada has been falling steadily from peak levels of US$ 78 billion in 2008.

- From 1991 through 1994 (the year NAFTA went into effect), the United States did run a trade surplus with Mexico. The United States has consistently run a trade deficit with Mexico since 1995. However, prior to 1991-1994, the United States ran both trade deficits and trade surpluses with its Southern partner. In particular, it ran a trade deficit from 1982 through 1990, and a trade surplus from 1970 through 1981.[2] This suggests that the factors that have a heavy impact on the U.S. trade balance with Mexico are not limited to NAFTA.

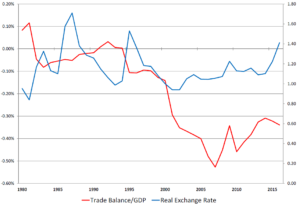

- A factor that seems to play a key role in the U.S. trade balance with Mexico is the real exchange rate. Simply put, the real exchange rate shows fluctuations in the value of a currency in excess of inflation differentials. Table I below compares the U.S. trade balance with Mexico relative to the U.S. gross domestic product against Mexico’s real exchange rate, over the period 1980-2016.[3] The U.S. trade balance with Mexico relative to the U.S. gross domestic product (“GDP”) is graphed on the left vertical axis. The ratio is positive where there is a surplus and negative where there is a deficit. Mexico’s real exchange rate is graphed on the right vertical axis. It is an index, based on the year 2000. Increases in the real exchange rate are indicative of the peso depreciating whereas decreases in the real exchange rate are indicative of the peso appreciating.

Table I

US-Mexico Trade Balance (Relative to US GDP) vs Real Exchange Rate:

1980-2016

- Table I shows very clearly that United States tends to post a surplus in its trade with Mexico when the peso appreciates and post a deficit when the peso depreciates. In particular, in the early 1980s the U.S. trade balance with Mexico went into from a surplus to a deficit as the peso heavily depreciated. The exact same thing happened in the mid-1990s. Since then, the U.S trade deficit with Mexico has co-existed with a depreciating peso.[4] This all means that exchange rate movements are a fundamental driver of the U.S. trade balance with Mexico.

- Crucially, the US$ 64 billion trade deficit that the United States posted with Mexico in 2016 is not the result of U.S. exports to Mexico stagnating or dropping since the inception of the NAFTA.[5] On the contrary, in 2016 U.S. exports to Mexico were four and a half times as large as they were in 1994 (US$ 230 billion compared to US$ 51 billion) while in 2016 Mexico’s exports to the United States were nearly six times as large as they were in 1994 (US$ 294 billion compared to US$ 50 billion).

- Equally important is the fact that (even without considering the increment in U.S. exports to Canada) NAFTA has boosted U.S. exports by over 4 times as the combined 13 other free trade agreements that the United States has signed. In particular, from 1994 through 2016 U.S. exports to Mexico rose by roughly US$ 180 billion. By contrast, the other 13 free trade agreements that the United States has signed have raised U.S. exports by only US$ 42 billion.[6]

- Thus, even if the bilateral trade balance is used as yardstick, it appears that both the United States and Mexico have greatly benefitted from enhanced market access opportunities under the NAFTA, although arguably Mexico more so than the United States.

- An important related issue is what the overall effect of the NAFTA has been upon production and employment in both the United States and Mexico. Quantifying such effects requires the use of economic models. That said, what is clear conceptually is that the increase of approximately US$ 240 billion in Mexican exports to the United States and US$ 180 billion in U.S. exports to Mexico did not come at the expense of an equivalent contraction in domestic production by local producers. This is the case because in a free trade agreement exports grow not only by reducing import-competing domestic production but also via the displacement of third-country exports and, more importantly, through an expansion in consumption, resulting from lower prices.[7] Thus, there should be much less than a one to one relationship between rising exports by Mexico (or the United States) and declining import-competing domestic production in the United States (or Mexico). If each country gained more exports than lost import-competing domestic production, it follows than, in both countries, the net effect of the NAFTA upon total employment is likely to have been positive.

[1] https://www.census.gov/foreign-trade/balance/index.html

[2] The U.S. Census data on bilateral trade balances are available beginning in 1985. Data before 1985 are available from the International Monetary Fund’s Direction of Trade.

[3] The U.S. trade balance with Mexico is scaled in terms of a numéraire (in this case, the U.S. GDP) to properly assess its magnitude over time. Data on the U.S. trade balance with Mexico, the U.S. GDP and Mexico’s real exchange rate are from the International Monetary Fund.

[4] Interestingly, at least since 1990 Mexico has posted routinely deficits on both its trade balance and its balance of trade on goods and services; however, the Mexican Government attaches no particular importance to this fact.

[5] Conversely, according to data from the U.S. Bureau of the Census, U.S. exports of goods to Korea have stagnated since the bilateral free trade agreement went into effect while U.S. exports of goods to Colombia and Panama have actually contracted since the adoption of the respective free trade agreements.

[6] Own calculations on the basis of data from the U.S. Bureau of the Census. In particular, to arrive at the US$ 42 billion figure the relevant increments in U.S. exports were added up. Such increments were calculated by deducting U.S. exports in the relevant base year (the year in which the respective free trade agreement was adopted) from U.S. exports in 2016. The list of the free trade agreements involved was taken from World Trade Organization, Trade Policy Review – United States: Report by the Secretariat, WT/TPR/S/350, circulated on 14 November 2016, at page 30, Table 2.2.1.

[7] This expansion in demand is similar to what happens in a market upon the arrival of a low-cost airline.

This a first post in a series of posts commenting on the NAFTA renegotiation process. For Part II click here.

_________________________

*The opinions presented in this Post are mine alone and do not represent in any way official views of King & Spalding LLP or its clients.

_________________________

To make sure you do not miss out on regular updates of the Regulation for Globalization Blog, please subscribe to this Blog.

Could you comment on the “Maquiladora effect” where manufacturing value chains are linked between US and Mexico in such a manner that both countries’ exports mutually interdependent.

Regards